Recommended Videos

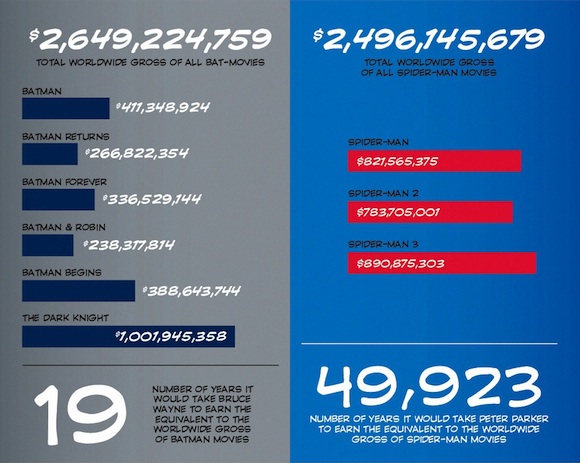

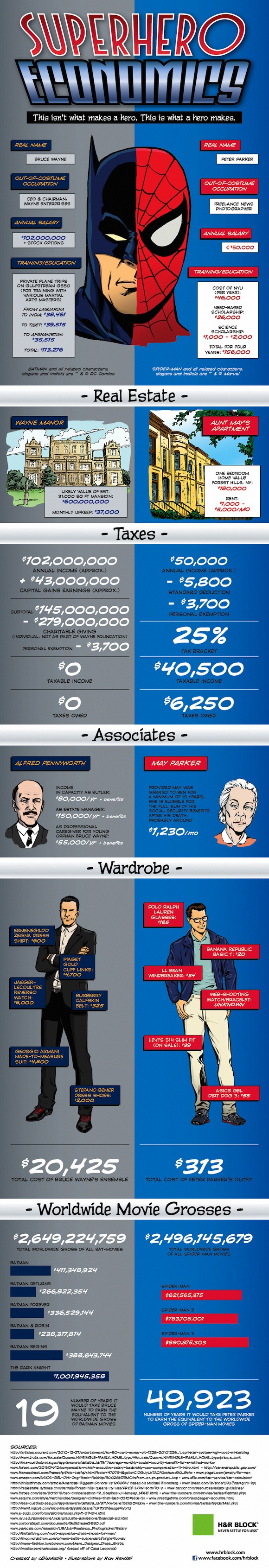

File under: somebody did this. H&R Block went straight for our nerd buttons by creating this infographic comparing the tax liability, income, and lifestyles of Bruce Wayne and Peter Parker. Probably the most interesting part for us? Despite his vast wealth, it would take Bruce Wayne almost twenty years to earn as much money as the Batman movie franchise has.

But it would take Peter Parker nearly fifty millennia to do the same for Spider-Man.

(via H&R Block.)

The Mary Sue is supported by our audience. When you purchase through links on our site, we may earn a small affiliate commission. Learn more