Earlier today, the Dow Jones Industrial Average gave Wall Street — and a healthy chunk of the Internet — quite a scare when it fell more than 1,000 points before healthily bouncing back later in the afternoon. Early reports tied the plunge to the hot-button finance story of the day — the turmoil in Greece over debt concerns — but as new details emerge, it appears that technical or math errors may have been to blame for the severity of the Dow’s plunge.

According to Reuters, “A trading error at a major firm was to blame for the day’s market plunge,” and market officials at NASDAQ and elsewhere are reviewing market activity between 2:00 and 3:00pm. A CNBC reporter claims that “trading firm” may have been Citigroup.

CNN Money breaks it down further, tying the Dow’s mini-crash to “technical glitches” that caused Procter & Gamble share prices to drop 37% in mere minutes:

In one of the most gut-wrenching hours in Wall Street history, the Dow plunged almost 1,000 points Thursday, before recovering some, as on a technical glitch in the trading of Procter & Gamble stock and fears about the European debt crisis spreading.

The selling was exacerbated by a huge drop in Dow component Procter & Gamble (PG, Fortune 500). There may have been technical glitches which caused it to plunge 37% in minutes. P&G’s slump was responsible for 172 points of the 992.60 the Dow initially lost.

The CNBC reporter’s explanation in the clip below is even more mundane: he speculates, based on conversations with sources, that someone may have hit “b” instead of “m” at their trading terminal, trading a thousand times more shares than they had planned.

The Dow Jones bounceback doesn’t mean we’re in the clear yet: As Kimon Berlin points out, on 10/24/1929 — Black Thursday — the markets were down 22.6% at midday, but down only 2.1% at close. But the suddenness of the plunge illustrates the scary degree of power that computer-automated trading programs have over the market: Just one bad input can make billions of dollars move — and disappear — in very short order.

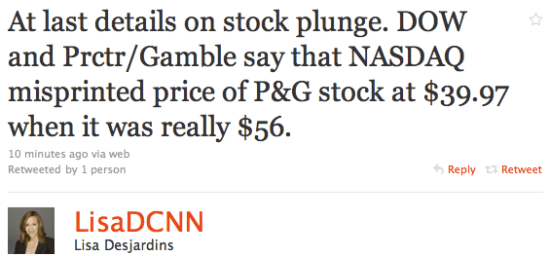

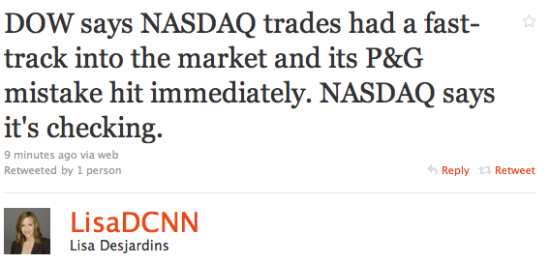

Update: According to CNN Radio reporter Lisa Desjardins, the tech error in question may have been on NASDAQ’s end.

Update2: Apparently, P&G wasn’t the only stock to experience a sudden, sharp decline: Stock for the consulting firm Accenture “plummeted from above $40 at 2:47 p.m. to $0.01 at 2:48 p.m,” pointing even more strongly towards a “technical snafu.” (h/t @dannysullivan)

(via CNN Money)

Published: May 6, 2010 04:52 pm