Gone are the sweet, sweet days of tax-free online shopping. At least, they might be soon, if an upcoming bill in Congress that would make sales tax standard online passes. Now might be a good time to check out those bookmarked shopping carts.

According to ABC News, the introduction of a bill requiring that sales tax be collected on online purchases stems from both a dire need to increase state revenue and the fact that tax-free online shopping often places brick-and-mortar establishments in a very bad economic position. After all, why buy directly from a physical store when you can get it on Amazon cheaper?

Online stores have been able to skirt charging sales tax due to a 1992 Supreme Court ruling that held that stores without a physical presence in the state where the customer lives do not have to include sales tax. Between the lower price points and the ease of internet-based transactions (deep down we all know that we’re only a few clicks away from blowing our entire paycheck on comics), small brick-and-mortar stores have suffered immensely, while online shopping has flourished. Technically, you are supposed to report online purchases when you file your state taxes and pay the sales tax there, but I’d venture that most people don’t know that, forget to do so, or you know, just choose not to.

A group of heavy-hitting websites that include eBay, Overstock, and Facebook have teamed up in protest of the proposed bill. Amazon, on the other hand, has offered support of the bill after battling it out with states like Texas, that demanded they levy sales tax because their distribution centers are located in the state. Traditional retailers with a web presence and brick-and-mortars, such as Barnes & Nobel, Wal-Mart, and Target also support the bill.

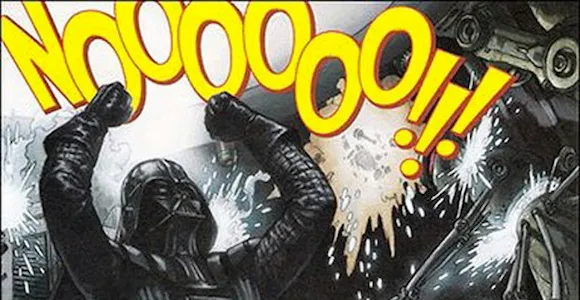

While it’s definitely the law to pay sales tax, and it sort of sucks that small businesses have been hurt so severely by the practice of tax-free online shopping, we’re still pretty sad we won’t be able to relish in that mischievous glee when we see something in a store we just know we can get cheaper online. So, here’s to you, late night tax-free shopping. I shall miss you dearly, though I’m sure my impulsive pocketbook won’t.

(via ABC News.)

Are you following The Mary Sue on Twitter, Facebook, Tumblr, Pinterest, & Google +?